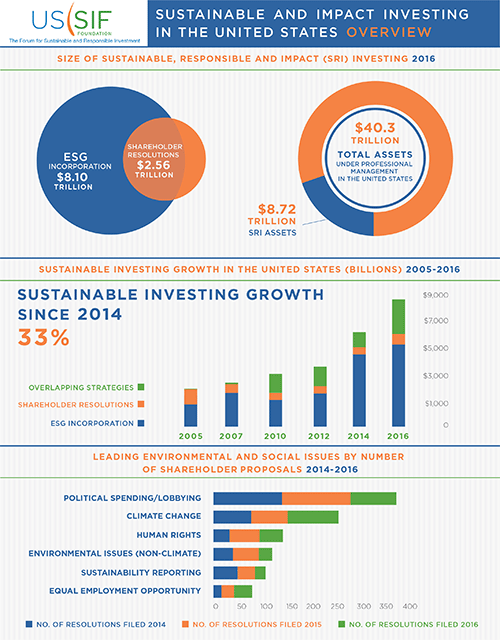

Would you like to invest according to your values and beliefs? If you’re concerned that your performance will suffer, that doesn’t need to be the case. We can show you how to invest for competitive returns while being consistent with your conscience. And you would not be alone. Today, 1 in every 5 dollars is being invested with a socially responsible mandate. Many individual investors, institutions and non-profit organizations require their money managers to incorporate a variety of different screens to ensure that their investments are in keeping with their personal or organizational missions.

What is SRI?

In its earliest days, SRI stood for Socially Responsible Investing, a term that is still used today, but the newer title—Sustainable, Responsible and Impact Investing–better reflects the way SRI has evolved over the years.

In its early stages, Socially Responsible Investing was an exclusionary process for investors who, for personal, religious, or political reasons, wanted to eliminate certain businesses from their portfolios, such as alcohol, tobacco, firearms, military contracting, animal testing, gambling, or repressive governments overseas.

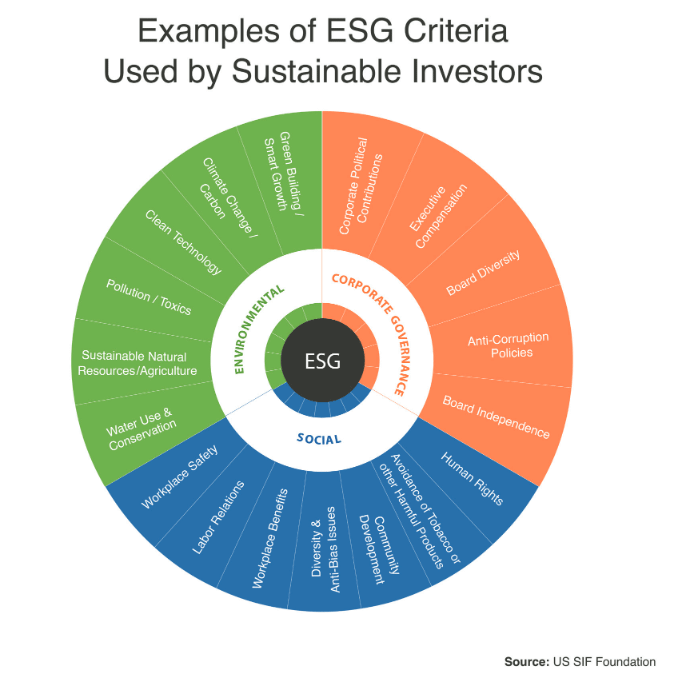

In recent years, SRI has evolved from a strictly exclusionary process to an inclusionary one. Sustainable investing today is a long term approach that incorporates Environmental, Social, and Governance factors into the investment process, often shortened to ESG.

Environmental

Analysis evaluates how a company performs as a steward of the natural environment. Some criteria are carbon emissions, air and water pollution, energy efficiency, waste management, biodiversity and deforestation.

Social

Analysis examines how a company manages relationships with its employees. , Criteria may include gender and diversity policies, human rights, labor standards, employee engagement, customer satisfaction, and community relations.

Governance

Governance analysis deals with a company’s performance in a number of issues, including board composition, executive compensation, audit committee structure, bribery and corruption policies, and lobbying activities.

As you might expect, it turns out that companies that score high in ESG screenings for their outstanding stewardship of the environment, their communities and their employees are among the best companies in the world. In many cases, ESG screening identifies companies with better financial performance and less legal liability. In fact, recent studies have shown that many companies with high ESG ratings perform better as investments than companies with low ratings. This is a powerful investing trend that is drawing in billions of dollars.

There are numerous options for SRI Investing, including stock and bond mutual funds, ETF’s, Separately Managed accounts, and Individual stocks and bonds.

To Learn More: Connect with Advisor